Description

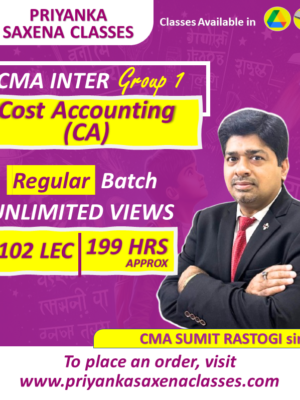

| COURSE LEVEL | CMA Inter |

|---|---|

| LECTURE DURATION | 250 Hours with 140 Lectures approx |

| TOTAL VIEWS | Unlimited Views |

| VIDEO LANGUAGE | English & Hindi Mix |

| RELEVANT ATTEMPT | June /Dec 2024 & Onwards |

| BATCH RECORDING | Latest Recording |

| STUDY MATERIAL | All Relevant Material |

| RUNS ON | Desktop, Laptop & Android |

| DOUBT SOLVING | WhatsApp Support | Email Support |

| SYSTEM REQUIREMENT | Windows 7 (Ultimate & Above) & Min. 2 GB RAM | Version 6 & Above (For Android Users) |

| PROCESSING TIME | Within 48 Hours (Parcel Will Be Dispatched Only After Receiving The Documents, If Required) |

| DELIVERY TIME | 6 to 8 Working Days (Depends On Location) |

| NOTE | Academy Will Not Increase Views. License Cost For New System Will Be Extra. Renewal must be considered if the validity expires |

Reviews

There are no reviews yet.